Suppose a friend is worried about paying the interest on a loan. On enquiry, we come to know that they haven’t yet taken that loan. Appalled, we would shake them, saying, “Are you nuts? Why are you worrying about paying interest on a loan you haven’t even taken?”

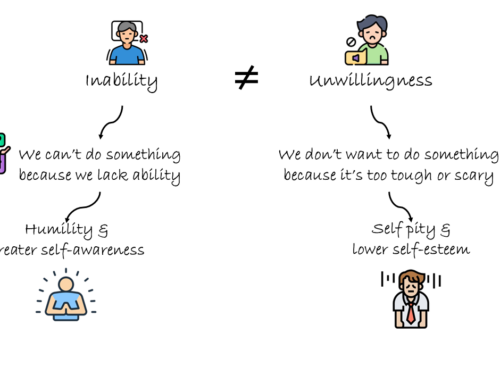

That’s sensible advice – and it’s advice we may need to give ourselves. Because we too do something similar whenever we worry about future problems; we waste our energy in obsessing over possibilities that hardly ever actualize. For example, finding a small swelling on our hand, we may start worrying that it might be a tumor; the tumor might be malignant and terminal; and we might have only a month to live. While our worry spree makes us increasingly panicky, the swelling disappears uneventfully.

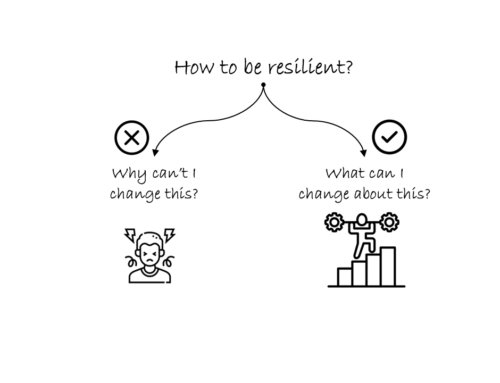

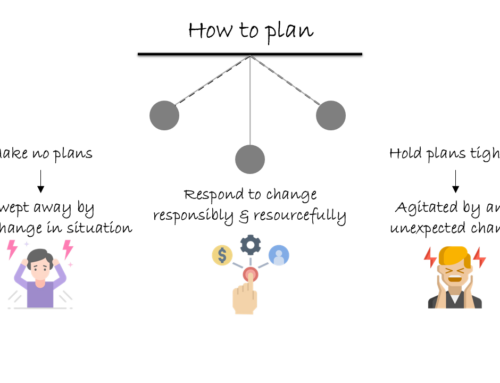

Instead of worrying about what all may go wrong in future, if we just focus on what is wrong right now, we will discover that things are not unmanageable. Still, shifting our focus to the actual situation is not easy, especially if we have unwittingly habituated ourselves to worrying.

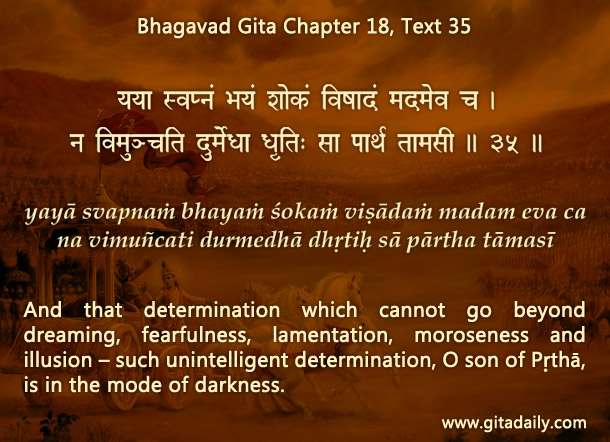

Gita wisdom explains that our thought habits are shaped by subtle forces of nature known as the modes. Worry is characteristic of the lowest among the three modes: the mode of ignorance. And habitual, compulsive, self-destructive worrying, the Bhagavad-gita (18.35) indicates, is characteristic of determination in the mode of ignorance.

To correct such stubborn, self-sabotaging thought patterns, we need to consistently connect ourselves with the supreme spiritual reality, God, Krishna, who exists beyond the three modes. When we fix our mind on him, we experience inner security and serenity, which enables us to resist the mind’s fits of anxiety. Being thus calmed, we can focus on addressing, in a mood of service, things as they really exist.

To know more about this verse, please click on the image

Explanation of article:

Podcast:

Download by “right-click and save”

Thanks Pravu,

This topic is so effective to stop worrying unnecessarily and it was so well explained.

Worry is the penalty that we bear on the loan that we assume to get